Streamlined Toll Data Collection & Saved 80% Time

For A Transportation Operator

Discover how an SME transport operator cut reconciliation time by 80% with a cloud-based solution using AWS Lambda, Snowflake, and Tableau.

Industry

Transport

Country

Australia

Project Duration

5 Months

Development Method

Agile

Team Size

6 Experts

Client Overview

Our client is a mid-sized transportation infrastructure operator managing multiple toll plazas across regional highways. Operating at an SME scale, their division oversees daily toll collection, revenue monitoring, and financial reporting across a distributed network.

Client Objective

The client approached us with a clear objective: to automate and accelerate toll collection and bank deposit reconciliation across their toll plaza network. They aimed to eliminate manual processes, reduce reconciliation time, and ensure 100% accuracy in financial reporting.

Project Challenges

Key Challenges In Toll And

Bank Reconciliation Faced by Infrastructure Operators

Despite having an established toll plaza network, the client faced mounting challenges in reconciling toll collections with corresponding bank deposits.

Fragmented Data from Multiple Toll Plazas

Each toll plaza transmitted data via SFTP in varied formats, making it difficult to aggregate, clean, and normalize the data for reconciliation. This lack of standardization led to significant processing delays and inconsistencies.

API-Based Bank Data Misalignment

While bank transactions were available through APIs, they often did not align in structure or timing with toll data. Matching entries between toll collections and deposits was time-consuming and frequently inaccurate.

Manual Reconciliation Is Error-Prone

The reconciliation process relied heavily on spreadsheets and human validation. This not only consumed valuable time but also increased the risk of financial discrepancies, affecting monthly reporting accuracy.

Lack of Real-Time Financial Visibility

Due to delayed reconciliation cycles, the finance and operations teams lacked timely insights into daily or weekly revenue trends. This limited their ability to make informed, data-driven decisions.

Our Client’s Project Solution

Scalable Cloud Solution For

Real-Time Toll & Bank Reconciliation

Using AWS, Snowflake & Tableau, this cloud-first platform supports growing toll data volumes, and offers a single source of truth for financial reporting—empowering infrastructure operators.

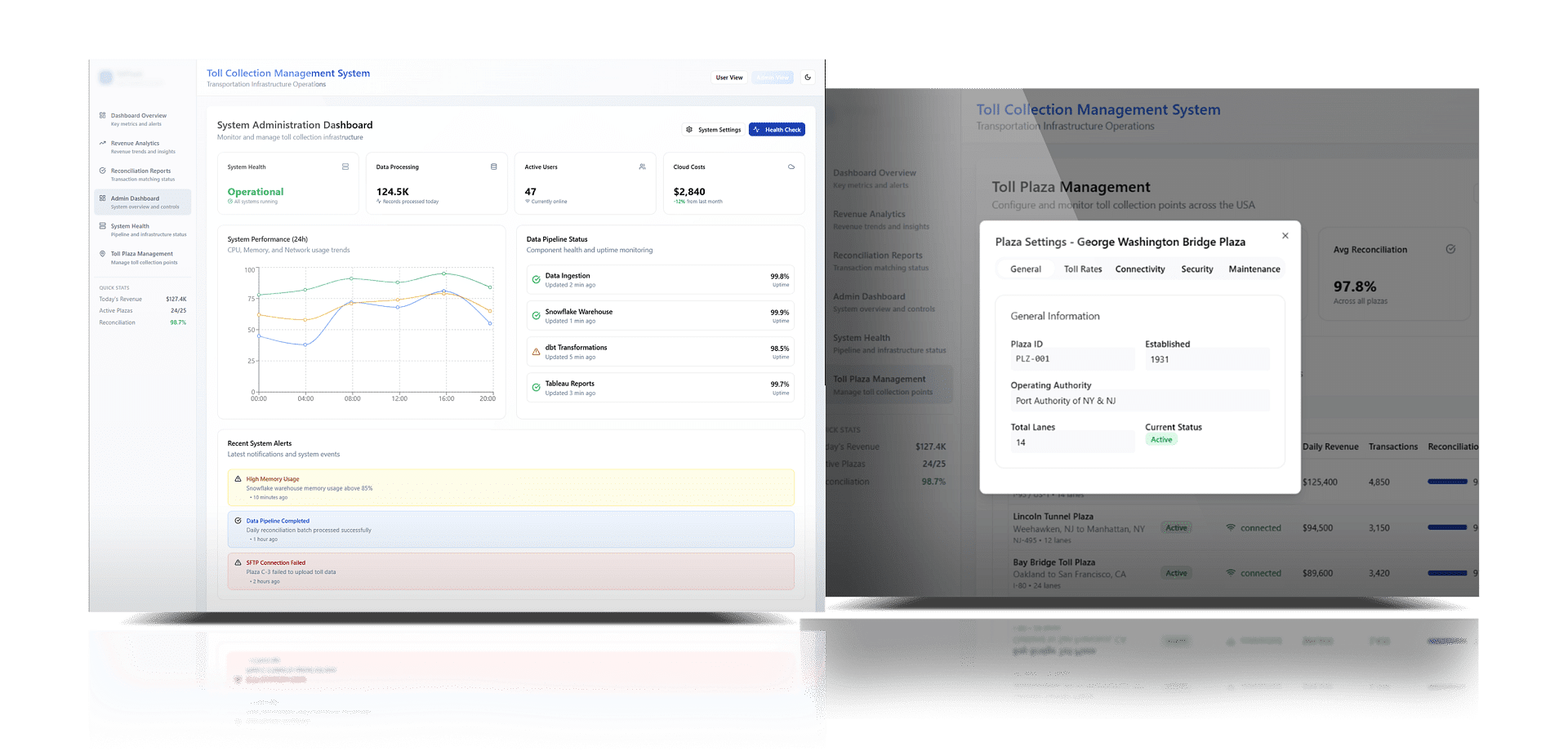

Automated Data Ingestion Via AWS Lambda

We used AWS Lambda functions to automate the ingestion of toll collection data from SFTP servers and bank transaction data from APIs. This enabled continuous, real-time data capture without manual effort.

Data Validation And Staging In Amazon S3

All incoming data was validated, normalized, and stored in Amazon S3, creating a centralized staging environment that ensured clean, structured data for downstream processing.

Cloud Data Warehousing With Snowflake

The processed data was loaded into Snowflake, a high-performance cloud data warehouse, where we built a structured data model using dbt (data build tool). This included fact and dimension tables to support reconciliation logic.

Business Rule-Based Reconciliation Using Dbt

We implemented a robust set of reconciliation rules in dbt to match toll collections with bank deposits. The system flagged mismatches, delays, and anomalies, allowing finance teams to act quickly and confidently.

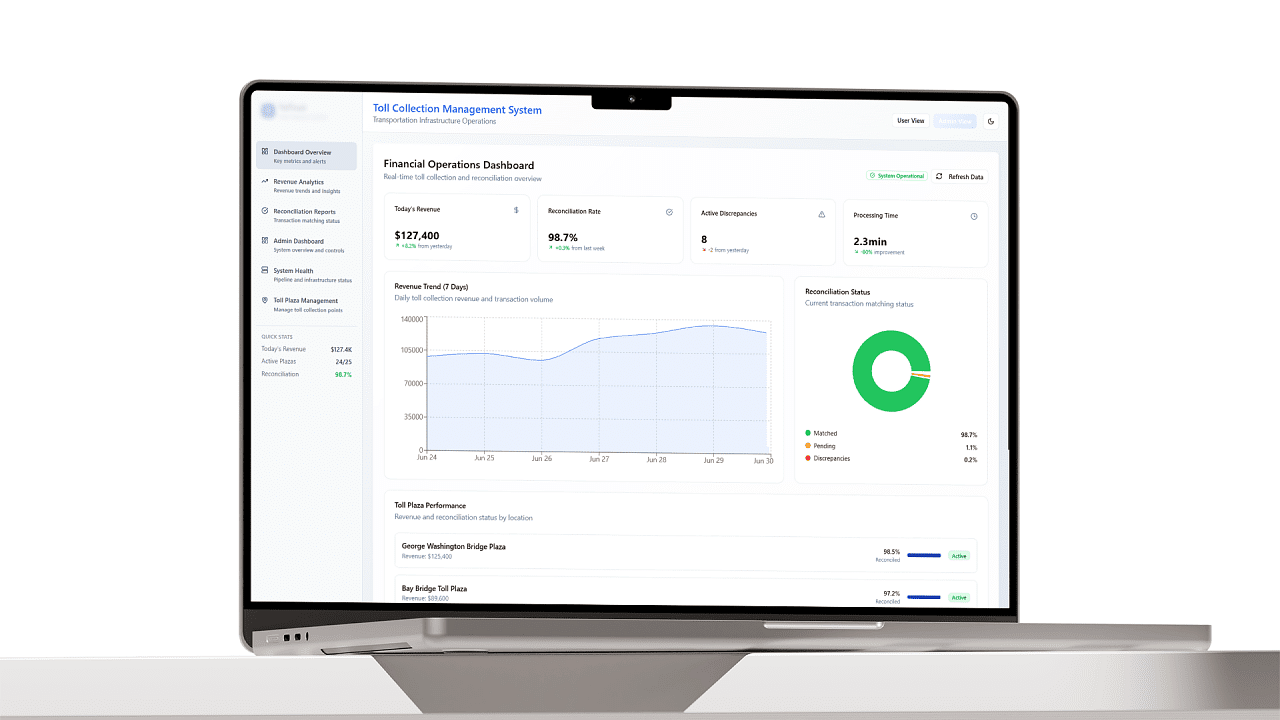

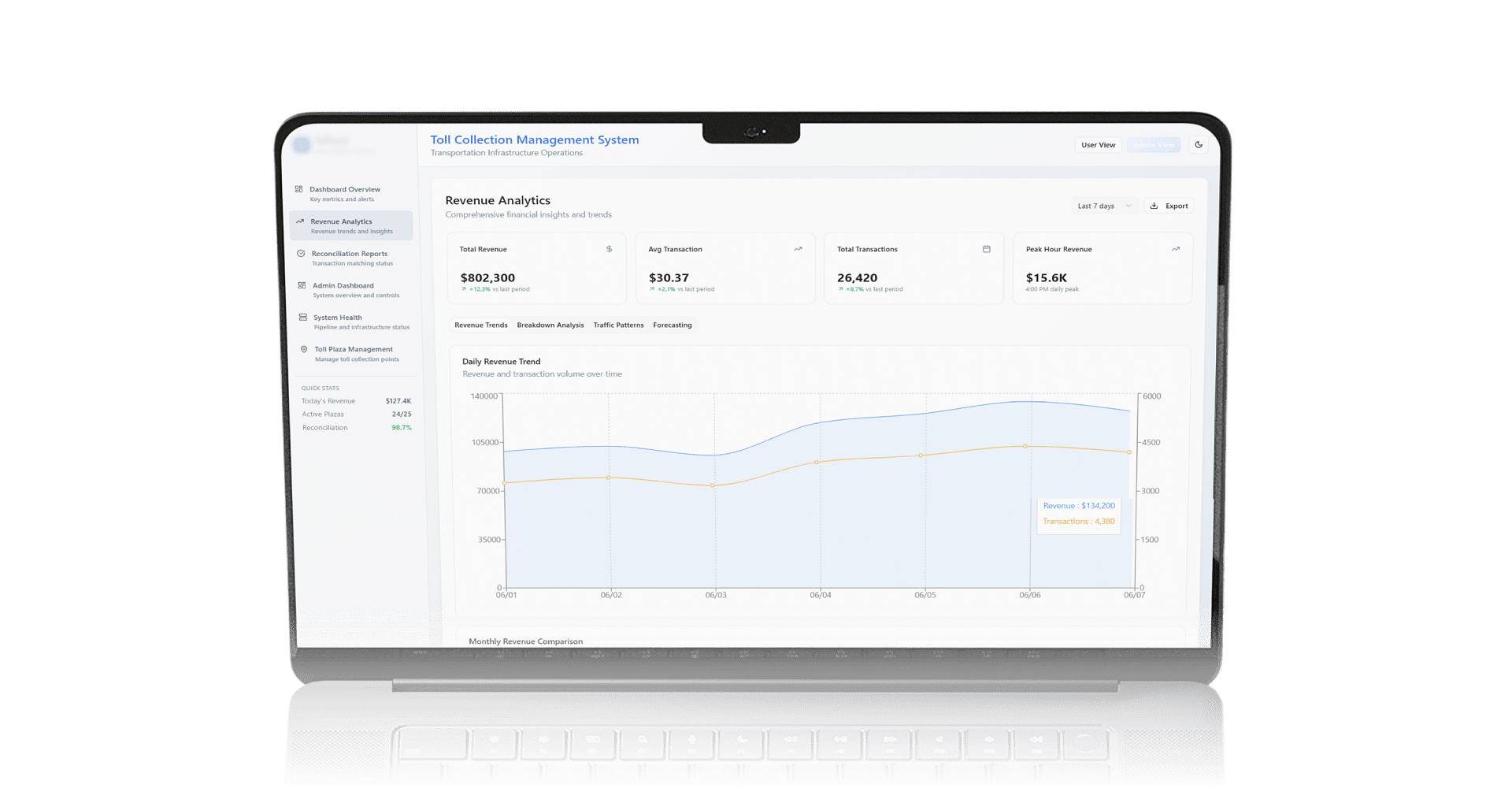

Interactive Reporting With Tableau

Tableau dashboards were directly connected to Snowflake, providing real-time financial and operational insights. Teams could instantly view reconciliation status, revenue trends, and unresolved discrepancies across all toll locations.

Secure, Scalable & Audit-Ready Architecture

Built on cloud-native services, the platform ensures end-to-end data encryption, automated logging, and easy auditability. Its serverless design enables effortless scaling with growing toll data volumes, while maintaining compliance and operational trust.

Streamline Your Toll Reconciliation

Start Seeing Results in Weeks!80% faster reconciliation with automation

95%+ accuracy in toll-bank matching

Real-time dashboards for full revenue visibility

Built to scale with multi-location operations

Our Client Project Success

80% Faster Toll Reconciliation & 95% Accuracy Achieved

With Cloud Automation

The cloud-native reconciliation solution delivered measurable business results, transforming how the client managed toll data and banking transactions across their infrastructure network.

80% Reduction In Reconciliation Time

By automating toll and bank data matching using AWS Lambda and Snowflake, we slashed the end-to-end reconciliation time, enabling faster revenue validation and improved financial agility.

95% Accuracy In Toll-Bank Matching

With structured reconciliation logic powered by dbt models, the system achieved high precision in matching SFTP-based toll data with API-based bank transactions, reducing errors and manual reviews.

100% Real-Time Financial Visibility

Using Tableau dashboards connected to Snowflake, finance and operations teams gained real-time access to toll revenue trends, unmatched transactions, and reconciliation status across all plazas.

50% Reduction In Manual Workload

Automated data ingestion and transformation replaced repetitive manual efforts, allowing the client’s teams to focus on exception handling and strategic financial planning.

Why Choose Us

Why Choose Webelight Solutions

As Your Go-To Partner For Toll And Bank Data Solutions?

Domain Expertise In Toll & Infrastructure Tech

We understand the complexities of toll collection systems, banking integrations, and financial reporting for infrastructure operators.

Cloud-First Architecture With Proven Tools

From AWS Lambda to Snowflake, dbt, and Tableau, we implement the best cloud-native tools for speed, reliability, and scale.

Data Accuracy & Financial Integrity At Core

We build systems that ensure real-time accuracy, data trust, and audit-readiness—critical for transport and finance teams.

Agile Delivery With Measurable ROI

We work fast, deliver value early, and focus on measurable KPIs like reconciliation speed, accuracy, and data visibility.

Long-Term Scalability & Flexibility

Our solutions are modular, extensible, and built to handle growing toll volumes, multi-plaza integrations, and evolving compliance needs.

Ongoing Support & Optimization

We don't just deliver and disappear. Our team offers system tuning and feature enhancements to ensure your reconciliation platform evolves with your operational and regulatory needs.

FAQs

Common Questions

We've compiled a list of frequently asked questions with clear and concise answers.

Get A Personalized Consultation

For Your Toll Reconciliation Needs.

Discover how transportation and infrastructure operators are reducing reconciliation time by 80%, improving financial accuracy to 95%, & gaining 100% real-time visibility into toll revenue.

Our Work

Explore More Case Studies

10+

Years of Experience

25+

Countries Served

110+

Tech Specialists

4.9/5

Star Ratings on Clutch

500+

Successful Digital Products

15+

Industries Served