Sarvdhan

Innovative & User Friendly Loan Management Application

Client Overview

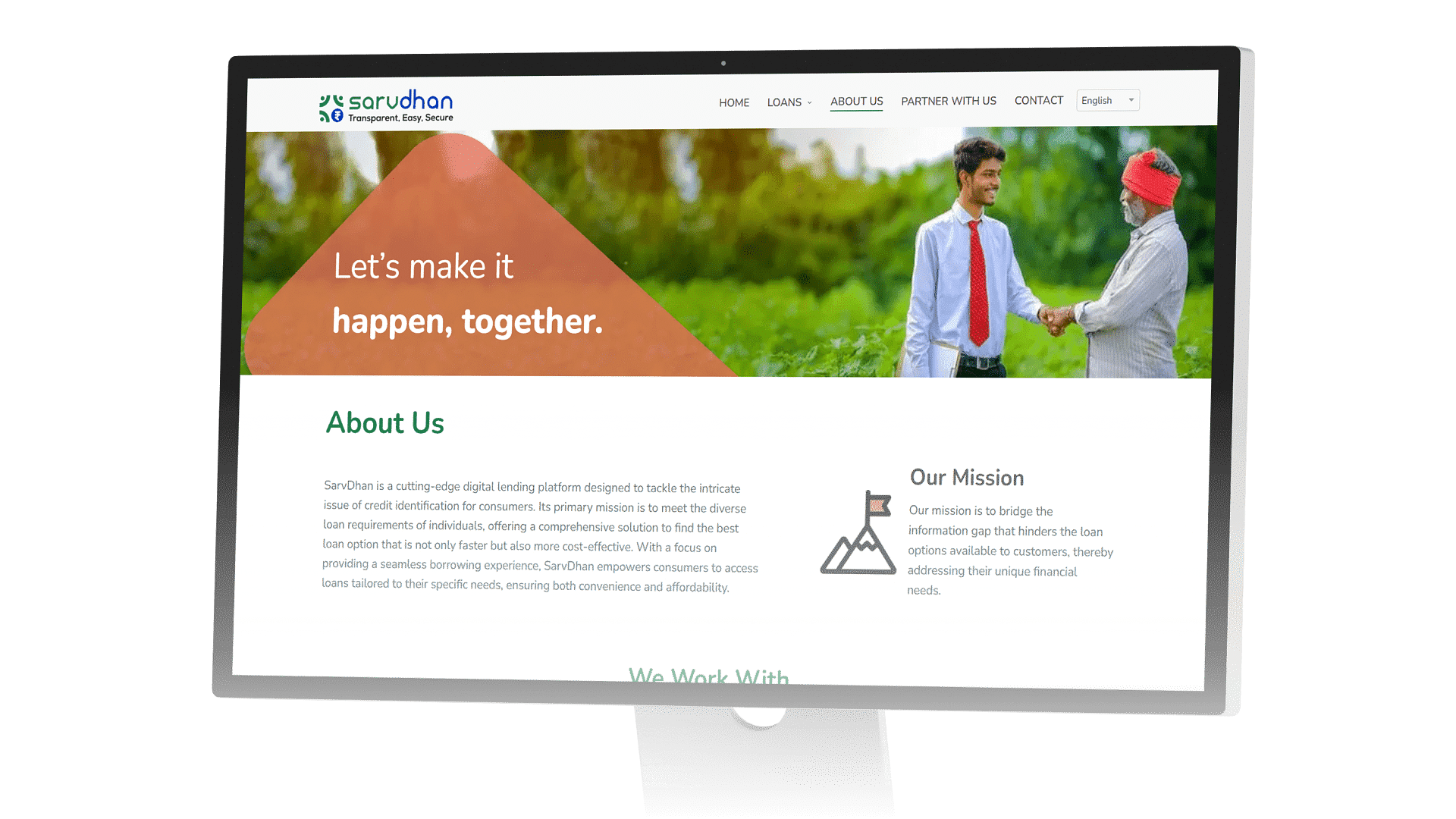

Sarvdhan Loan Application is an innovative platform that revolutionizes the loan application experience for individuals and businesses. By offering a user-friendly interface, the platform simplifies the entire loan management process and streamlines collaboration between users, partners, and internal teams.

Leveraging cutting-edge technologies, the platform is designed for long-term flexibility, ensuring it remains at the forefront of the industry.

Business type:

Technologies:

Industry:

1

Manual Process of Loan Application

Inefficiencies and errors arose from manual entry of loan applications, making the process time-consuming.

2

Need for Scalability and Flexibility

The platform needed to scale with business growth and adapt to changing market conditions.

3

Limited Integration with Financial Service Providers

Insufficient integration with financial service providers led to manual data entry and delayed processing.

4

Complicated User Interface and Inadequate Reporting

The cumbersome user interface caused user frustration, while the lack of robust reporting and analytics hindered tracking of loan applications and customer interactions.

Automated Loan Processing

Automates the entire loan application process, reducing manual errors and speeding up approval times.

Advanced Financial Integrations

Seamlessly integrates with multiple financial service providers, ensuring real-time data synchronization and efficient processing.

Scalable and Adaptive Architecture

Built to scale with business growth, the platform adapts to changing market demands, ensuring long-term flexibility.

Comprehensive Reporting and Analytics

Provides robust tools for tracking loan applications and customer interactions, enabling data-driven decision-making.

Digital Document Management

Enables secure upload, verification, and storage of documents, minimizing paperwork and accelerating loan processing timelines.

Farmer-Centric User Experience

Designed with the end-user in mind, the platform offers an intuitive interface in regional languages, ensuring accessibility and ease of use for farmers across different demographics.

Real-Time Application Status Tracking

Applicants can track their loan application status in real-time, increasing transparency and reducing dependency on manual follow-ups.

Secure & Compliant Infrastructure

Implements advanced security protocols and compliance checks to protect sensitive financial data and ensure adherence to regulatory requirements.

1

Personalized Loan Recommendations

2

Streamlined Online Loan Application Process

3

Access to Competitive Agricultural Loan Interest Rates

4

Wide Network of Agri-Financial Partners

5

Strategic AgriTech & Financial Partnerships

6

Real-Time Loan Status Tracking

7

Secure Digital Document Upload & Verification

8

Multi-Language and Regional Access

Digitally Empowered Farmer Onboarding

Simplified the onboarding process for rural farmers by integrating digital KYC and land ownership verification, improving reach and reducing drop-off rates.

Automated Risk Profiling Engine

Implemented a backend engine to assess creditworthiness based on alternative data like crop cycles, historical yield, and transaction behavior—enabling smarter loan decisions.

Integrated Ecosystem for Lending Partners

Created a unified platform for banks, NBFCs, and agri-fintechs to collaborate, manage leads, and disburse loans more efficiently.

Unified Dashboard for Stakeholder Visibility

Developed a centralized dashboard for lenders and admins to monitor loan performance, user behavior, and application metrics in one place.

Localized User Experience with Vernacular Support

Enabled multilingual access to the platform, making the loan journey seamless for farmers in Tier 2 and Tier 3 regions using their native language.

Adaptive Loan Schemes Based on Crop Patterns

Configured the system to support dynamic loan product offerings based on regional crop seasons, rainfall patterns, and farmer needs.

By partnering with Webelight Solutions, Sarvdhan Loan Application was able to overcome their challenges and transform their loan application process. The new web application has streamlined processes, improved user experience, and enhanced integration with financial service providers, positioning Sarvdhan for continued growth and success in the financial services industry.

Empowering Farmers With A Prosperous Future.